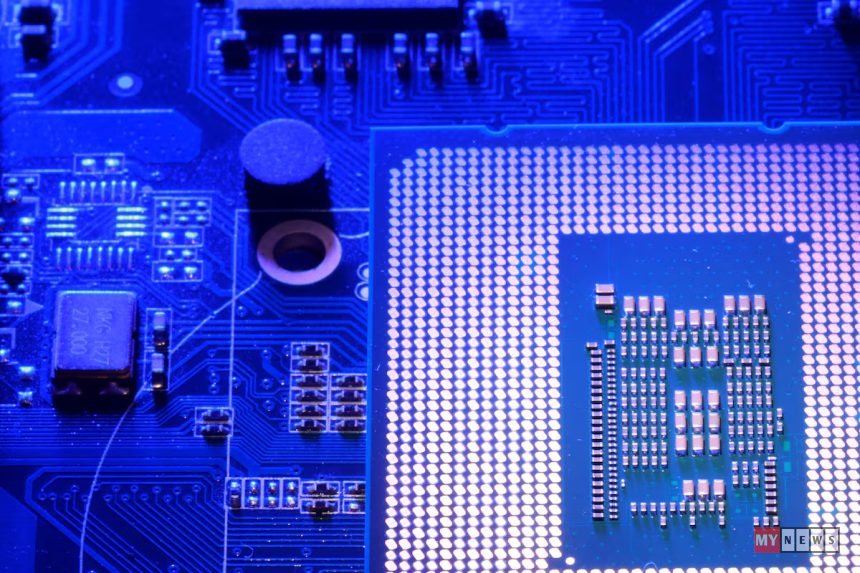

The Trump administration is weighing a bold new move that could shake global electronics supply chains — imposing tariffs on imported devices based on how many semiconductor chips they contain. According to people aware of the early discussions, the proposal would allow the U.S. Commerce Department to calculate tariffs as a percentage of the estimated chip value in each product.

This means that a wide spectrum of consumer goods — from basic items like toothbrushes with electronic features to complex gadgets such as laptops and smartphones — could face higher costs if the plan is approved. The administration argues this step is necessary to reduce America’s reliance on foreign manufacturing and push companies to set up factories in the United States.

Speaking on the matter, a White House spokesperson emphasized the national security angle:

“America cannot be reliant on foreign imports for the semiconductor products that are essential for our national and economic security.”

The Trump team is combining this tariff plan with tax incentives, deregulation, and energy policies designed to lure critical industries back home. However, economists caution that such measures may further fuel inflation, which is already running above the U.S. Federal Reserve’s 2% target. Higher tariffs would not only raise the cost of imported goods but could also make U.S.-made products more expensive, since manufacturers still depend on foreign components.

Trump has already signaled a tough stance on imports this year. Recently, his government slapped 100% duties on branded pharmaceuticals and 25% tariffs on heavy-duty trucks. The administration also launched investigations into imports of semiconductors and medicines, claiming that heavy dependence on overseas supply poses a strategic risk.

In the case of electronics, early drafts of the tariff structure suggest a 25% rate on imported chip-heavy devices. Products coming from allies such as Japan and the European Union could face a slightly lower rate, around 15%, but final figures have not been confirmed. Major chip producers outside the U.S., including Taiwan and South Korea, would likely be most affected.

The government has also floated an exemption plan that would allow companies to offset tariffs if they shift a significant portion of production to American soil. For example, a dollar-for-dollar exemption could be available if firms move at least half of their manufacturing operations into the U.S. But reports suggest the White House remains skeptical of large carve-outs, with President Trump personally opposed to broad exemptions.

For global tech giants, this policy could reshape supply chain decisions overnight. If tariffs are enforced, U.S. consumers may face higher prices for everyday electronics, while companies may be forced to accelerate investment in American facilities to avoid extra costs.

The proposal remains under review, but its potential impact is clear: it could redefine the competitive landscape of global electronics manufacturing, with Washington betting on tariffs as a tool to restore industrial strength at home.