Over the next decade, the global economy must channel nearly 3.5% of GDP each year—around $4.2trn—into upgrading social, transport, energy, and digital infrastructure, according to Beinsure analyzed report and highlighted key points.

Urbanization and shifting demographics drive demand in emerging markets, while developed economies struggle with aging systems.

Pandemic shocks and geopolitical tensions exposed fragile supply chains, pushing the U.S. and Europe toward reshoring and friendshoring, which in turn fuels demand for manufacturing sites, logistics hubs, and transport links.

At the same time, digital infrastructure is buckling under the surge in power demand from record growth in data centers tied to the AI boom.

5 key highlights

- $4.2trn annual spend needed – Equivalent to 3.5% of global GDP, required each year through 2035 for transport, energy, social, and digital systems.

- Emerging markets dominate demand – Two-thirds of the $11.5trn global infrastructure need lies in EMDEs, led by China ($1.5trn) and India ($1trn).

- Energy transition drives investment – $26–30.2trn required by 2035 to expand renewables, storage, and grids, nearly 70% of total infrastructure spend.

- Digital “power problem” – AI and cloud-driven data center growth could triple electricity demand by 2030, straining grids and regulatory systems.

- Private capital’s expanding role – Infrastructure assets under management surged to $1.5trn in 2024, with investors targeting 6–10% stable, inflation-linked returns.

Global Infrastructure Needs

- The U.S. will need to invest more than $1 trn in non-energy infrastructure over ten years, with roads accounting for the bulk.

- China’s target runs to $1.5 trn, India close to $1 trn, while France, Germany, the UK, and Spain together require about $500 mn.

- Altogether, global investment needs add up to $11.5 trn, two-thirds of it in emerging markets.

- Latin America captures this tension perfectly: rising trade diversification and rerouting drive demand, but elevated risks complicate delivery.

Energy infrastructure dominates the picture

Between $26trn and $30.2trn is needed by 2035 to meet electrification and decarbonization goals, equal to nearly 70% of total infrastructure spend, according to Insurance in a Fragmenting World.

Despite doubling renewable generation investment over the last decade, grids and storage remain underbuilt, driving bottlenecks and higher system costs.

Europe alone must spend $110–150bn each year on distribution, transmission, and interconnection upgrades.

Globally, the energy investment gap sits at $1.5trn annually, with shortfalls most visible in the U.S. and emerging economies. Closing it is crucial for climate targets, power reliability, and energy security.

Private capital has become the linchpin of this financing push

Unlisted infrastructure assets under management have jumped from less than $25bn in 2005 to more than $1.5trn in 2024. according to Global Economic and Insurance Market Outlook.

Investors are pivoting away from traditional transport and utilities toward energy-transition projects and digital networks.

Beyond cash, private players bring lifecycle discipline, delivery expertise, and risk-sharing models via public-private partnerships, direct ownership, and infrastructure debt. Their strategies now tilt toward steady, inflation-linked returns of 6–10%, rather than private-equity-style upside.

The challenge ahead is less about ambition and more about execution

The next phase of global infrastructure investment must be defined by both ambition and execution.

While mobilizing 3.5% of global GDP annually is necessary, it is not sufficient. Now, what matters is aligning capital, policy, and system design to overcome the real-world constraints that continue to slow delivery.

The barriers are increasingly structural, ranging from permitting delays and grid congestion to fragmented regulatory frameworks and institutional capacity gaps in EMDEs. Addressing these challenges will require a dual shift.

First, governments must fast-track permitting and landuse approvals, harmonize remuneration and regulatory frameworks across jurisdictions, and introduce fast-track mechanisms for priority infrastructure.

Simplifying and digitizing procurement processes can reduce lead times and improve transparency. Enhancing project preparation facilities and technical assistance, particularly in lower-income regions, will be key to moving projects from concept to bankability.

Strengthening the capacity of subnational authorities and state-owned enterprises, which are often key implementers, is equally critical.

Investors must transition from broad allocations to more targeted, theme-based strategies that focus on energy systems, digital infrastructure, resilient urban mobility, and social infrastructure to deliver resilient, inflation-linked returns.

Greater use of blended finance and risk mitigation tools is also required to mobilize capital at scale in high-risk regions. Without this alignment, execution will remain the bottleneck.

System costs will rise, stranded assets will proliferate, and the gap between infrastructure ambitions and physical delivery will continue to widen.

The global rush for infrastructure

Urbanization to push global infrastructure demand as cities face 2050 strain. Infrastructure sits at the base of economic activity, shaping growth and stability.

Building and maintaining transport corridors, ports, and airports are not just technical projects—they are catalysts for development. Strong infrastructure networks raise productivity, cut costs, and reduce risks for businesses, which often bear the brunt of weak systems.

Global demand for infrastructure is rising fast. Emerging and developing markets are expanding at more than twice the rate of advanced economies, creating urgent need for new projects. Population growth compounds the pressure.

By 2040, the world’s population is set to climb by 25%, with urban populations swelling by 46% as migration to cities accelerates.

This wave of urbanization is straining existing networks and forcing rapid expansion of transport, housing, water, and energy systems. By 2050, an estimated 70% of humanity will be city dwellers. That shift makes climate-resilient urban infrastructure not optional, but essential.

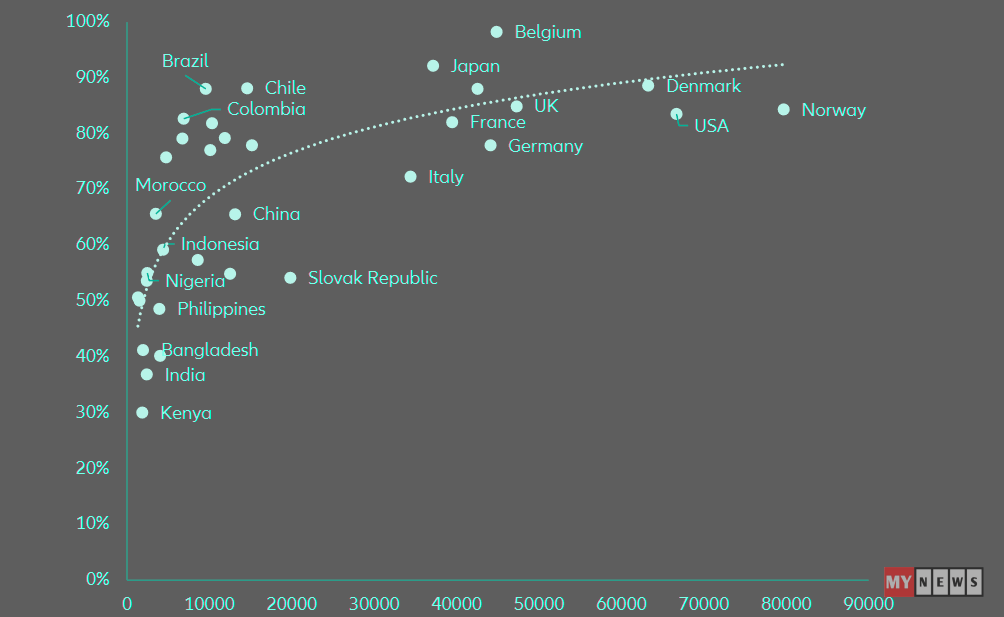

GDP per capita (2015 USD – x-axis) vs urbanization rate (%)

Demographic shifts and urbanization are identified as key drivers for infrastructure demand in emerging markets, whilst the necessity for upgrading aged infrastructures is a key factor in developing markets.

The rapid urbanization that is occurring in emerging economies with young, growing populations – such as India, Southeast Asia and some parts of Africa – is resulting in the need for extensive new infrastructure.

This infrastructure includes roads, public transit systems, water/sanitation systems and power grids, which are required to service the rapidly growing cities.

Concurrently, the rapid urbanization witnessed in Asia and Africa has precipitated an expansion in infrastructure, encompassing highways, railways, ports and airports.

Conversely, numerous advanced economies are confronted with the challenge of ageing infrastructure, which was constructed during the mid-20th century and is now in need of renewal or replacement. For instance, a significant proportion of Europe’s infrastructure was constructed during the post-WWII economic boom.

The average age of EU power grids is now over 40 years, necessitating upgrades to ensure they can handle modern loads.

The ageing demographics of Japan and Western Europe may result in a slight moderation of demand growth; however, even in these regions, there is a pressing need for substantial investment in order to maintain and modernize existing infrastructure.

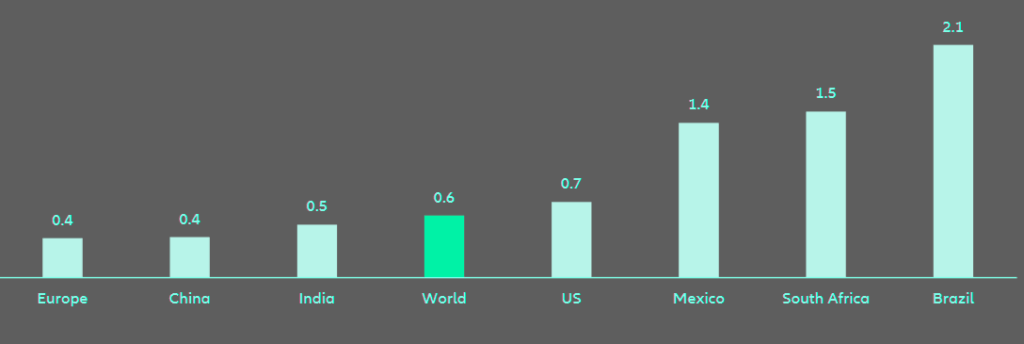

Infrastructure investment gap (% of 2020 GDP)

The collective impact of these infrastructure demand-side elements gives rise to the necessity for non-energy infrastructure investment amounting to approximately 1% of global GDP. In order to estimate non-energy infrastructure investment needs on a cross-national basis, the methodology outlined in the ADB (2017) study is adapted and applied.

The latest estimates indicate that the global infrastructure investment gap is approximately half a percentage point of global GDP, given the current investment commitments and expected needs.

It is evident that current levels of global infrastructure spending are inadequate in meeting the demands of achieving both economic development and sustainability goals.

The G20 asserts that global investment in infrastructure is inadequate, with emerging economies experiencing particularly pronounced deficiencies in this regard.

Mapping the infrastructure investment frontier

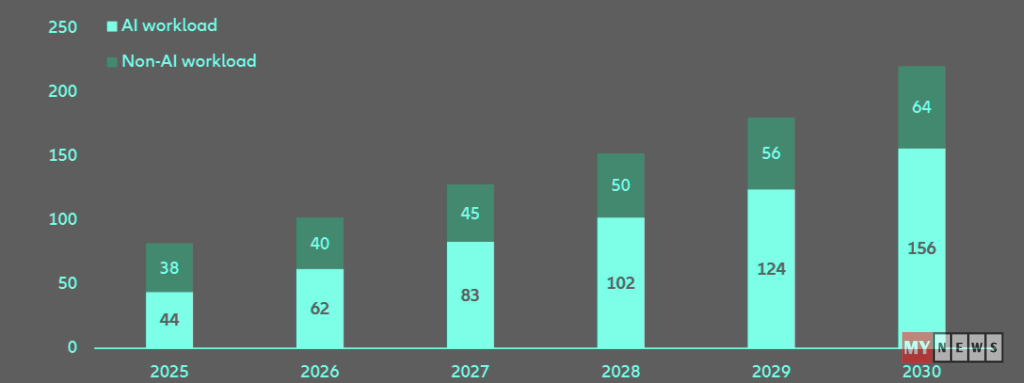

Digital infrastructure is entering a high-demand era, with artificial intelligence and cloud computing accelerating the need for computing power. Data centers are being built at record pace, yet the industry faces a paradox: capital flows into hyperscale and edge facilities, but power has emerged as the binding constraint.

This “digital power problem” is already visible. In the U.S. and Asia, hyperscalers run up against limited energy availability, substation bottlenecks, and long delays for grid interconnection.

AI workloads in particular are consuming massive amounts of electricity. McKinsey projects global demand from data centers could triple by 2030, a trajectory at odds with decarbonization timelines and existing grid capacity.

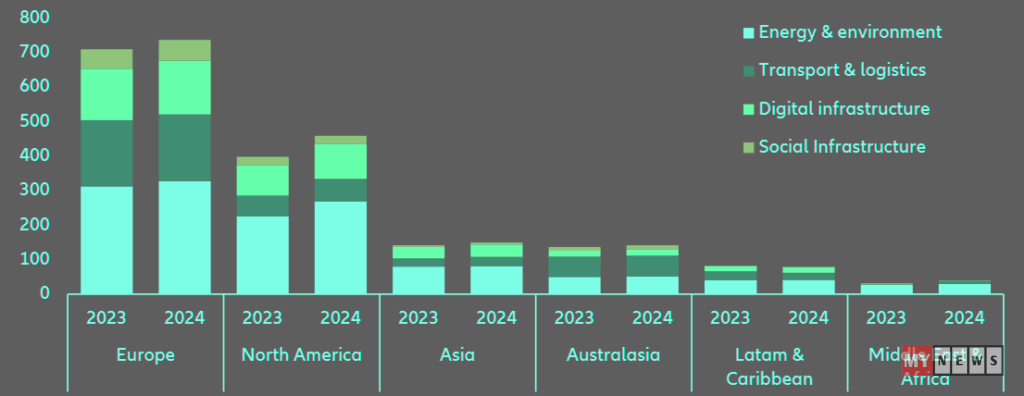

Portfolio companies by geography and sector (total number)

Regional growth patterns now hinge on both energy supply and politics. In the U.S., Virginia’s “Data Center Alley” has reached saturation, forcing expansion into states like Texas, Ohio, and Georgia, though substation access remains scarce.

The Trump administration may relax permitting, but uncertainty persists over federal backing for grid upgrades and clean energy incentives.

- Europe shows sharper divergence. The Nordics—Sweden, Finland, Norway—offer renewable energy, cool climates, and policy support, making them attractive growth zones.

- Germany and the Netherlands, by contrast, face zoning restrictions and ESG hurdles that could tighten under rising climate-skeptic political influence.

- Asia presents a mixed picture. India is ramping up Tier II city infrastructure under favorable localization policies, while Singapore has opted for a cautious path, enforcing stringent green building rules.

Global data center total capital expenditures driven by AI, by category and scenario, 2025-2030 projection, $ tn

The sector’s growth is undeniable, but its trajectory is now inseparable from power availability, regulatory clarity, and political will. Overcrowding in hotspots underscores the fragility of expansion plans in the age of AI.

Estimated global data center capital demand, continued momentum scenario, in gigawatts

At the same time, transport infrastructure is entering a new strategic phase as climate commitments, urbanization, and shifting trade dynamics converge with the rise of systems-based infrastructure planning.

The focus of attention is shifting from roads and runways to integrated, low-emission, digitally managed mobility networks. Investor appetite is following this pivot.

While traditional assets continue to receive capital investment, there is an increasing focus on electrified rail, intermodal freight, low-carbon ports and urban transit systems.

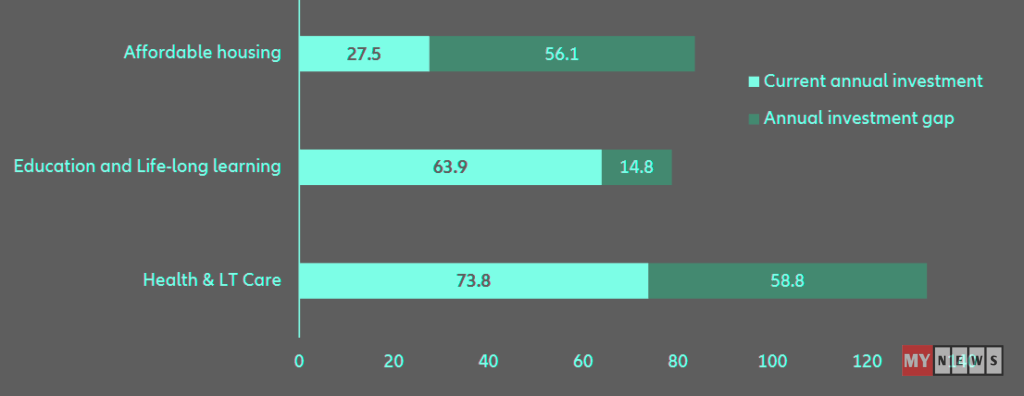

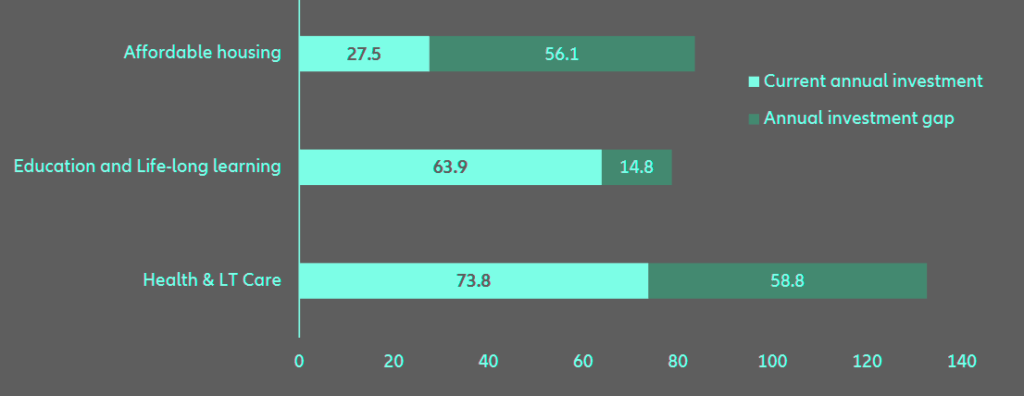

Estimated European social infrastructure gap by 2030 (€ bn)

Often overlooked next to transport and energy megaprojects, social infrastructure is steadily moving to the forefront of long-term investment agendas.

The aforementioned sectors, which include healthcare, education, housing, water, and civic facilities, form the foundation of inclusive and resilient societies.

Historically underfinanced due to its indirect returns and public-good nature, the sector is gaining new attention as demographic ageing, climate stress, and inequality prompt governments and investors to rethink priorities.

The utilization of public-private partnerships, social bonds, impact funds and outcome-based financing mechanisms has seen a marked increase in recent years, with a view to mobilizing capital whilst preserving accountability.

Infrastructure demands of the net-zero economy

The race to cut carbon emissions is rewriting global infrastructure priorities. Energy, transport, and buildings are at the center of this transformation, requiring deep upgrades not only to meet rising demand but also to decarbonize at speed.

Expanding renewables, modernizing grids, deploying storage, electrifying transport, and reinforcing climate resilience all demand unprecedented levels of investment.

Governments are mobilizing

- In Europe, the Green Deal targets a 55% cut in emissions by 2030, driving hundreds of billions of euros annually into clean energy, retrofits, and transit networks.

- In the U.S., federal funding has steadied, but the need for resilient, low-carbon systems is only intensifying.

- China, already the largest builder of low-carbon infrastructure, is accelerating toward peak emissions by 2030 and neutrality by 2060.

The transition to a more electrified economy reshapes energy markets everywhere. Even under moderate scenarios, structural change is inevitable. Electricity demand is set to surge nearly 47% in the next decade, fueled by data centers, automation, and electrification.

In the largest economies, electricity’s share of final energy use will rise by 14–17 percentage points under a baseline path, and up to 29 points under a net-zero trajectory.

Renewable expansion remains the engine. Wind and solar output will more than double in Europe and rise sixfold in China. Other low-carbon sources—biomass, nuclear, waste-to-energy, geothermal—are expected to grow.

Coal and other fossil fuels, by contrast, will be steadily phased out as grids pivot toward cleaner, more flexible systems.

The implication is clear: infrastructure investment is no longer a matter of incremental upgrades. It’s the foundation for hitting net-zero, keeping economies powered, and ensuring resilience in the face of accelerating climate pressure.

How private capital is powering the shift

Private capital has become central to how infrastructure is developed, financed, and maintained worldwide.

Governments, stretched by pandemic recovery and competing fiscal demands, increasingly rely on private investors to fill funding gaps and keep essential projects moving. What was once a domain almost entirely funded by taxpayers has turned into a global investment opportunity.

The role of private capital extends beyond financing

It brings technical expertise, long-term planning, and greater efficiency to infrastructure delivery.

Properly structured public-private partnerships encourage lifecycle cost optimization and innovation in design, often cutting costs while improving service quality.

When private investors own or operate assets, accountability rises—returns depend on performance, which drives closer monitoring and tighter management.

The scale of involvement has grown sharply

In 2009, unlisted infrastructure assets under management were worth about $20bn. By 2024, they exceeded $1.5trn.

That growth capital is now powering the sector’s transition, ensuring infrastructure is no longer just a public obligation but also a cornerstone of private investment strategy.

The scope of deal activity has expanded from conventional sectors such as transportation and utilities to encompass energy transition and digital infrastructure themes.

This evolution is evidenced by the prominence of data centers, fiber networks, renewable platforms, and battery storage among the most substantial annual transactions.

Resilient infra returns across economic cycle

This rapid expansion indicates that private capital is not only filling existing funding gaps but also reshaping the infrastructure landscape by financing new technologies and business models.

Average return by asset class during the worst ten quarters and performance during high-inflation scenarios

Expected return for US private infrastructure investments (%)

In considering the future of the global infrastructure agenda, it is essential to recognize that the manner in which capital is allocated and the amount of capital mobilized are equally pivotal.

Achieving an annual growth rate of approximately 3.5% of global GDP necessitates the resolution of the binding constraints that have emerged in relation to grids, storage, permits, and institutional capacity.

This is particularly salient in EMDEs, where two-thirds of the nonenergy gap is concentrated.

Energy constitutes nearly 70% of the total volume of infrastructure transactions worldwide, reflecting a transition from the augmentation of renewable energy generation to the facilitation of system flexibility. In parallel, digital infrastructure confronts a similar physical limitation as artificial intelligence (AI)-driven demand intersects with power shortages.

FAQ

How much will the world need to invest annually in infrastructure over the next decade?

Which regions face the largest infrastructure investment requirements?

Why is energy infrastructure the dominant investment priority?

How is digital infrastructure being reshaped by AI and cloud growth?

What role does private capital play in closing the funding gap?

What structural barriers slow delivery of infrastructure projects?

What returns are investors seeking in infrastructure assets?