By My Newspaper | Business News

Tata Sons IPO: The much-anticipated Tata Sons IPO may no longer see the light of day, as both factions of Tata Trusts have reportedly reached a rare unanimous decision against listing the holding company of the $300 billion Tata Group.

According to a report by The Hindu Business Line, both groups within the Trusts believe that taking Tata Sons public would not align with the conglomerate’s long-term philosophy of balancing profitability with philanthropy — a hallmark of the Tata legacy.

Tata Trusts Stand Firm: No IPO, No Compromise

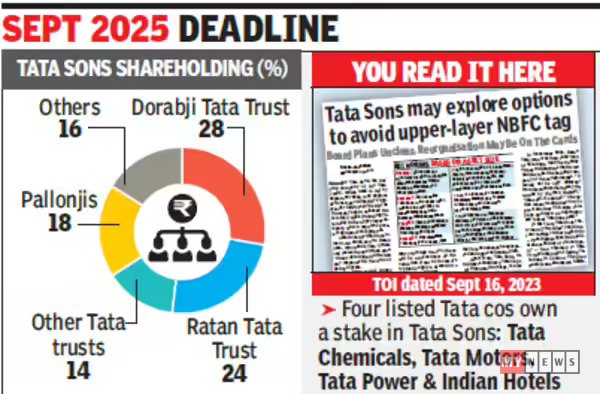

The decision marks a turning point in one of India’s most-watched corporate debates. Despite rising market interest and pressure from the Shapoorji Pallonji (SP) Group, which owns an 18.4% stake in Tata Sons, the Trusts have chosen to prioritize governance stability and legacy preservation over market valuation.

A source close to Noel Tata told The Hindu Business Line,

“Why should we bail out the SP Group now? Did they ask us before running up a debt of ₹50,000 crore? And where has the money gone?”

This statement reflects the deepening rift between the two historically linked business families. Despite family ties through marriage, insiders confirm that business decisions within Tata Trusts remain independent and principle-driven.

The trustees’ united stance centers around a key concern — that public shareholders could dilute control, alter board dynamics, and threaten the philanthropic mandate of Tata Trusts, which collectively hold around 66% of Tata Sons.

SP Group’s Push for a Tata Sons IPO

The SP Group, burdened by high leverage and liquidity constraints, has long sought to monetize its stake through an IPO.

Its 18.4% holding in Tata Sons is valued between ₹1.5–2 lakh crore, based on an estimated valuation of ₹11 lakh crore for the conglomerate.

Listing Tata Sons could have unlocked immense value for the SP Group, enabling it to reduce debt and strengthen its balance sheet. However, the move has faced stiff resistance from the Trusts and the Tata leadership, who prefer to retain private ownership and avoid market-driven short-termism.

(External Source: The Hindu Business Line)

RBI’s NBFC Rules and Tata Sons’ Strategic Shift

The Tata Sons IPO debate intensified after the Reserve Bank of India (RBI) designated Tata Sons as an Upper Layer NBFC (NBFC-UL) in 2022 — a classification that mandates listing within three years.

However, in January 2025, Tata Sons surrendered its NBFC license, reverting to a private holding company structure. This effectively removed any regulatory obligation to go public.

The company has since focused on debt reduction, simplifying group structures, and ensuring compliance with RBI’s deregulatory framework. The group is currently awaiting final approval for deregistration from the central bank.

(External Source: RBI Official Website)

Transparency Concerns Inside Tata Trusts

Despite the unified stance, reports suggest that not all trustees were initially informed of the IPO deliberations. A trustee from the Mehli Mistry faction reportedly raised questions about transparency in communication between the Tata Sons board and the Trust leadership.

According to insiders, when trustees asked whether an IPO proposal was under evaluation, the response was:

“We are not at liberty to share that information.”

This episode has reignited internal discussions about governance communication and oversight within the Trusts — a theme that has historically shaped Tata Group’s leadership culture.

No Listing, No Exit — What’s Next for the SP Group?

With the Tata Sons IPO now firmly off the table, analysts say the SP Group’s liquidity path remains uncertain. A structured buyback arrangement or private settlement may eventually be explored to resolve the ownership stalemate.

Industry experts believe that Tata Sons’ decision reaffirms its commitment to long-term stewardship rather than market capitalization. As one veteran fund manager told My Newspaper,

“This decision shows Tata’s DNA — protecting values over valuation. Their mission isn’t just about profits, it’s about purpose.”

The Bottom Line

By shelving the Tata Sons IPO, the Trusts have chosen continuity over commercialization. The move ensures that India’s most respected conglomerate remains guided by its founding ethos — a rare combination of industrial excellence and social responsibility.

For the SP Group, however, the road to unlocking value appears narrower than ever.

And for India Inc., this decision serves as a reminder that legacy, control, and purpose can sometimes outweigh market opportunity.

📰 Internal Link:

For more in-depth coverage on business governance and corporate strategy, visit My Newspaper Business Section.