Stretched valuations for artificial intelligence companies and challenges to the Federal Reserve’s independence have fueled the risks of a “sharp market correction,” the Bank of England said on Wednesday.

In its quarterly financial stability update, the UK central bank said asset valuations had continued to rise and credit spreads tighten since its June review, despite “persistent material uncertainty around the global macroeconomic outlook.”

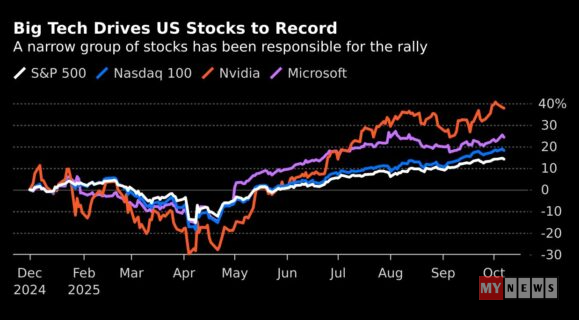

Equity market valuations appear “stretched” with “technology companies focused on AI” particularly vulnerable, especially if “expectations around the impact of AI become less optimistic,” officials said, according to minutes of the Financial Policy Committee meeting held on Oct. 2.

Worries about a potential AI bubble have grown as a record-breaking rally in US stocks has lifted valuations. The tech-heavy Nasdaq 100 Index is up 18% this year, trading at 28 times forward earnings versus a 10-year average of 23.

That’s sparked comparisons to the dot-com craze of the late 1990s that ended in a spectacular crash and a wave of bankruptcies, although some market participants including at Goldman Sachs Group Inc. have pushed back on bubble fears, and positioning indicators show investors remain bullish about further gains.

However, the BOE warned of “material bottlenecks to AI progress” that could harm valuations. These may come from power, data, or commodity supply chains — as well as conceptual breakthroughs which change the anticipated AI infrastructure requirements.

The BOE will carry out further work on broader impacts, including lending to AI firms and related industries. Recent financing deals have raised eyebrows on Wall Street for their “circular” nature.

Fed Credibility

Another threat to the financial system stems from the US, where central bank independence is subject to “continued commentary” amid President Donald Trump’s attempts to change its board, as well as his repeated criticism of Fed Chair Jerome Powell’s monetary policy stance.

“Central bank operational independence underpins monetary and financial stability,” the FPC meeting record showed. “A sudden or significant change in perceptions of Federal Reserve credibility could result in a sharp repricing of dollar assets, including US sovereign debt markets, with the potential for increased volatility, risk premia and global spillovers.”

That could hurt global markets more broadly because other countries’ borrowing rates can be correlated to those in the US, the BOE said.

Officials also cited two US credit defaults in the automobiles sector, without naming the firms, and said those failures reinforced threats that the BOE had already called out.

“Their financing appeared to display several common factors including high leverage, weak underwriting standards, opacity, complex structures, and the degree of reliance on credit rating agencies,” the report said. Their failures illustrate “how corporate defaults could impact bank resilience and credit markets simultaneously.”

First Brands Group filed for bankruptcy in late September, sending shock waves through credit markets and reigniting longstanding fears over the use of supply-chain financing to create off-balance sheet debt. The company disclosed more than $10 billion in total liabilities in its Chapter 11 filing, and the impact of its collapse continues to reverberate across hedge funds, direct lenders and banks.

That followed the downfall of Tricolor Holdings Inc., which had built its business selling used cars and making loans to lower-income and undocumented immigrants. US prosecutors are also looking into allegations of fraud at the company.

Systemic Risk

The central bank also published the results of its twice-yearly systemic risk survey, which showed cyberattacks and geopolitical risk remain the two most-frequently cited threats.

While the perceived probability of a “high-impact event” hitting the UK financial system was at a similar level over the short-term, it rose over the medium-term, defined as one to three years.

Still, the BOE said that the UK financial sector remained resilient and that banks were well equipped to handle threats “even if economic and financial conditions were to be substantially worse than expected.”